Claim Center

Call 877-242-2544 anytime, day or night, to report claims. You may also contact your independent agent to report a claim.

- Personal & Business ClaimsLearn More

- Life ClaimsLearn More

- Workers' Compensation ClaimsLearn More

Plan & Protect

Reduce risks and enjoy peace of mind with these tips and insights to protect what matters most.

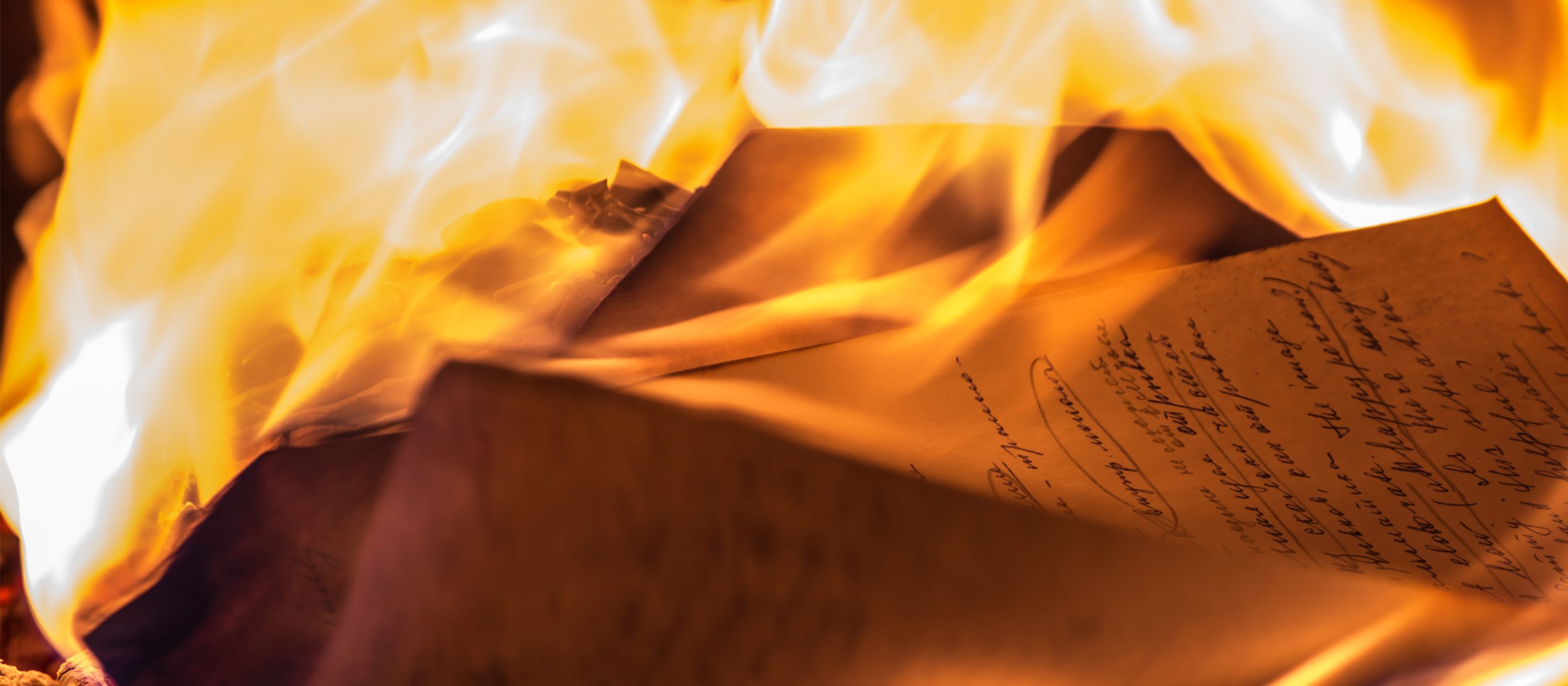

Safeguard Valuable Business Records & Papers

Take steps to protect paper documents and records.

Even in our electronic, computer-driven world, few businesses can operate without acquiring a number of valuable papers and physical records. Losing them to a fire or natural disaster could seriously affect business operations. Before you have a loss, take steps to protect valuable papers, or consider ways to store copies.

You know your specific business needs, but valuable papers and records may include:

- property deeds or construction plans

- patient, customer or employee records (remember that some may contain information protected by state and federal privacy laws)

- financial documents

- original copyrights or patents to key products

- product specifications

- manuscripts or blueprints

- customer lists

- licenses, permits, contracts

Any business could experience a loss of valuable papers and records, most commonly from an accidental cause such as a fire. Earthquake or weather events such as tornado, hurricane or flood also account for a significant number of losses. Water damage can also occur from a plumbing failure, accidental discharge from a fire suppression system or backup of sewer and drains. And documents sometimes are the target of criminals seeking proprietary data or information for identity theft.

Replacing your valuable papers and records can be expensive and time consuming. Take precautions to protect your business by storing copies of documents and records at an off-site location.

Most commercial insurance policies include limited coverage to replace valuable papers and records. Additional coverage can be added to your policy by endorsement to cover certain situations at your business or when working off-site. Your insurance agent can help you determine how much coverage you need to protect your business.

When a loss occurs, your insurance claims representative can assist you with locating vendors that specialize in remediation and restoration of valuable papers and records. USA.gov provides assistance with replacing vehicle registrations, tax returns, county and federal documents.

This loss control information is advisory only. The author assumes no responsibility for management or control of loss control activities. Not all exposures are identified in this article. Contact your local, independent insurance agent for coverage advice and policy service.