Claim Center

We're in the business of helping people, providing prompt and personal claims service when you need us the most.

Call 877-242-2544 anytime, day or night, to report claims. You may also contact your independent agent to report a claim.

- Personal & Business ClaimsLearn More

- Life ClaimsLearn More

- Workers' Compensation ClaimsLearn More

Plan & Protect

Reduce risks and enjoy peace of mind with these tips and insights to protect what matters most.

Flood vs. Water Damage and Their Coverages

Flood and water damage coverage is not the same, and something to consider wherever you live.

When water enters your home, the damage can be swift and severe—but not all water-related incidents are treated the same by your insurance policy. While flood and water damage losses share some common attributes, it’s important to understand how their coverages differ.

Main Types of Floods

Flood is the most common natural disaster in the U.S. and occurs in every state and territory, causing an average of $5 billion in damages each year. More concerning is the rising number and severity of flood events which continues to increase.

Flood is a general and temporary condition of partial or complete overflow of two or more acres of normally dry land area or two or more properties, at least one of which is on the policyholder’s property, as a result of various inclement weather events.

Water Damage

Similar to floods, water damage is consistently among the most common and severe causes of loss for homeowners.

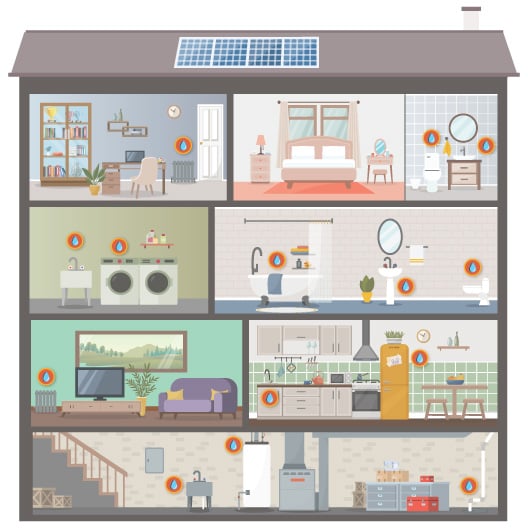

Water damage typically stems from an on-premises source such as burst water pipes or overflowing toilets, or a faulty roof that allows rain to enter.

These types of claims are five times more likely than theft and thirteen times more likely than fire. For extensive water damage events causing homeowners to vacate their homes, they spend nearly four months away on average.

These incidents can happen anywhere and in any type of home. If left unchecked, it could cause severe damage to the home’s interior, appliances and valuables. Installing an automatic water shut-off device is a solution to provide the best level of protection against water loss.

Are you Covered?

Homeowner policies do not include flood insurance in the base policy and while many provide water damage coverage to some extent, the amount and type of coverage varies.

Your independent agent can help explain the differences between water damage and flood damage, and how your policies might respond in the event of a covered claim. They can help guide you through your purchase options and recommend a plan that best fits your needs.

This loss control information is advisory only. The author assumes no responsibility for management or control of loss control activities. Not all exposures are identified in this article. Contact your local, independent insurance agent for coverage advice and policy service.